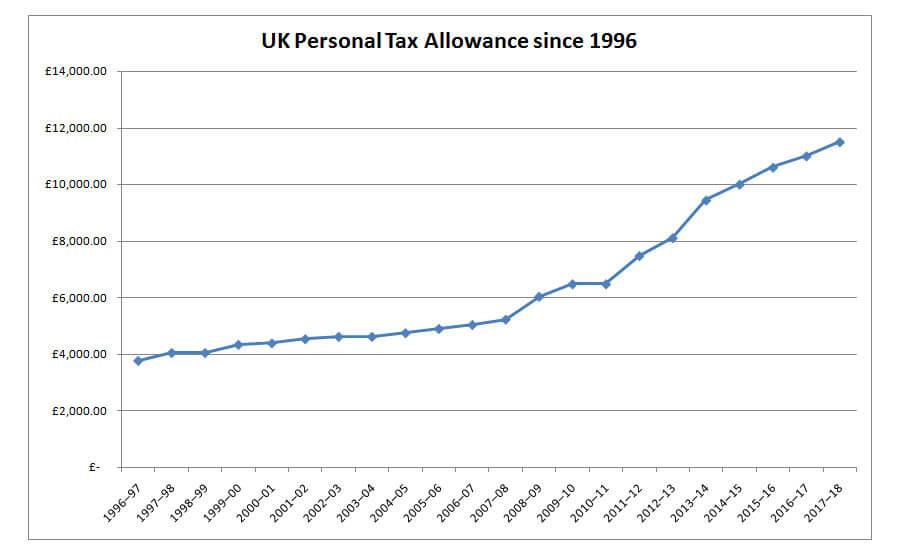

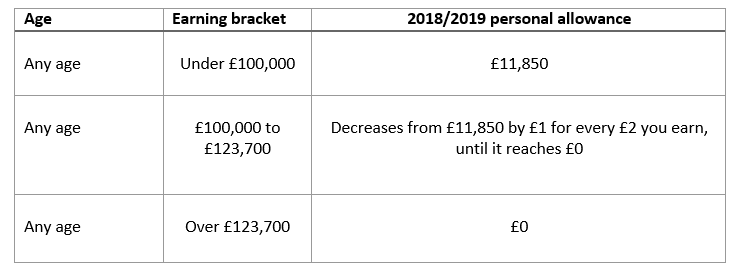

After reaching the UK personal allowance threshold, are you taxed on all the money you've earned or just the money earned over the allowance? - Quora

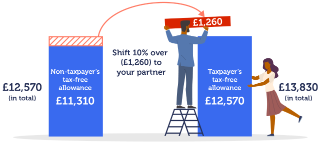

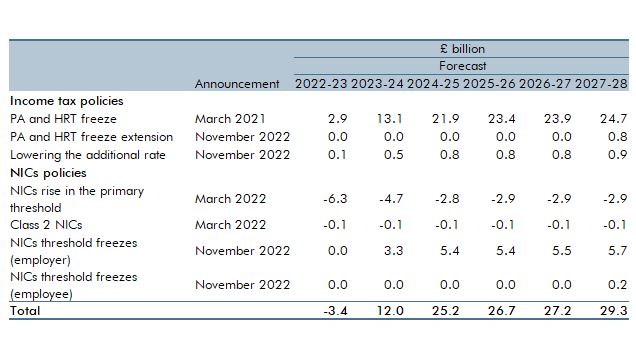

Budget 2024: See whether you win or lose from tax and national insurance tweaks | UK News | Sky News

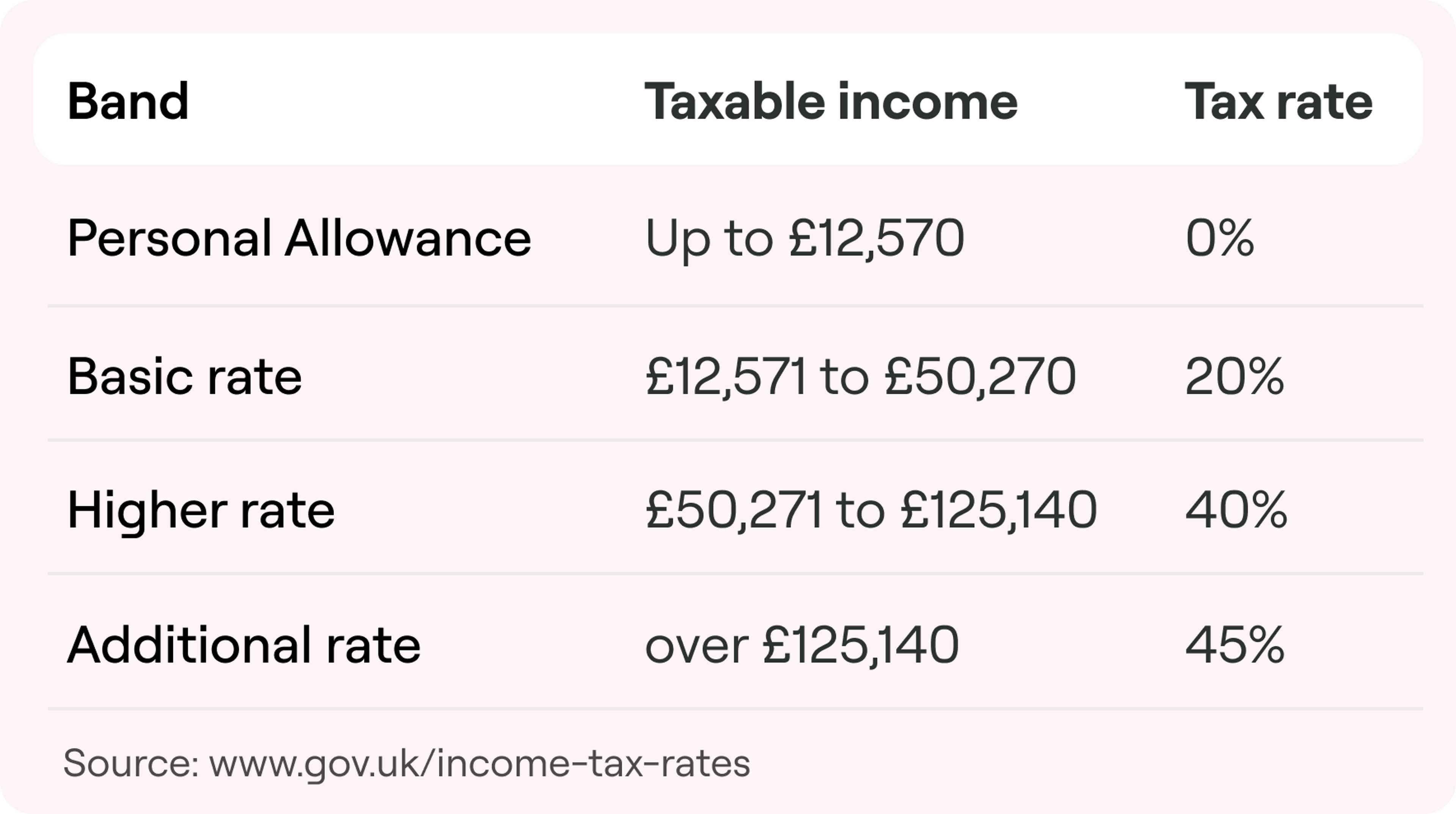

UK Tax Rates, Thresholds and Allowances for Self-Employed People and Employers in 2024/25 and 2023/24 | The Accountancy Partnership